A change to your pension benefits

As the Trustee of the Cadent Gas Pension Scheme, we are required to carry out a GMP equalisation exercise by law. This equalises pension benefits for men and women to take account of the unequal effects of GMP within the pension entitlement. Some members may see an increase to their current pension through this process.

At the start of this year, we shared a proposal to undertake GMP conversion, which is one way to carry out the process of GMP equalisation going forward. This would replace some of the elements that make up your pension while retaining the same current overall value of pension.

We were also required by law to consult with all Scheme members whose benefits may be affected by the proposal, so that they had the opportunity to share their feedback with us.

We sent all members a leaflet explaining the proposed changes at the end of January 2025. You can view a copy of the consultation leaflet below. The consultation closed on 28 February 2025.

After careful consideration of the feedback from members – by both the Trustee and the Company, along with their relevant advisers – the Trustee and the Company have decided to go ahead with GMP conversion.

View GMP conversion outcome letterWe would like to thank all members who took the time to provide feedback on our proposal. We carefully considered all feedback received and responded to individual members’ questions where appropriate. We also updated the FAQs on the Scheme website to reflect common questions that arose during the consultation, which you can find below.

Do I need to do anything?

No, you don’t need to do anything. If you have a GMP component as part of your pension, we have all the information we need to carry out the one-off GMP equalisation and GMP conversion calculations. We will write to you with further information in due course.

If you have Lifetime Allowance Protection and haven’t let us know, please do so by emailing cgpstrustees@cadentgas.com.

What happens next?

Now that the Trustee and the Company have decided to go ahead with GMP conversion, the following will happen:

If you are already receiving your pension: We will keep you updated with how the exercise is progressing through 2026 and into 2027.

If you are a deferred member (not yet taking your pension): We propose to carry out GMP conversion for deferred members at the time they start to take their pension. However, these calculations will take some time to implement. So if you start payment of your pension before the GMP conversion implementation date, we may need to make a GMP conversion adjustment at a later date.

For more information, you can:

- View the GMP consultation leaflet issued in January 2025

- View the GMP conversion consultation outcome letter issued in April 2025

- Read the FAQs below

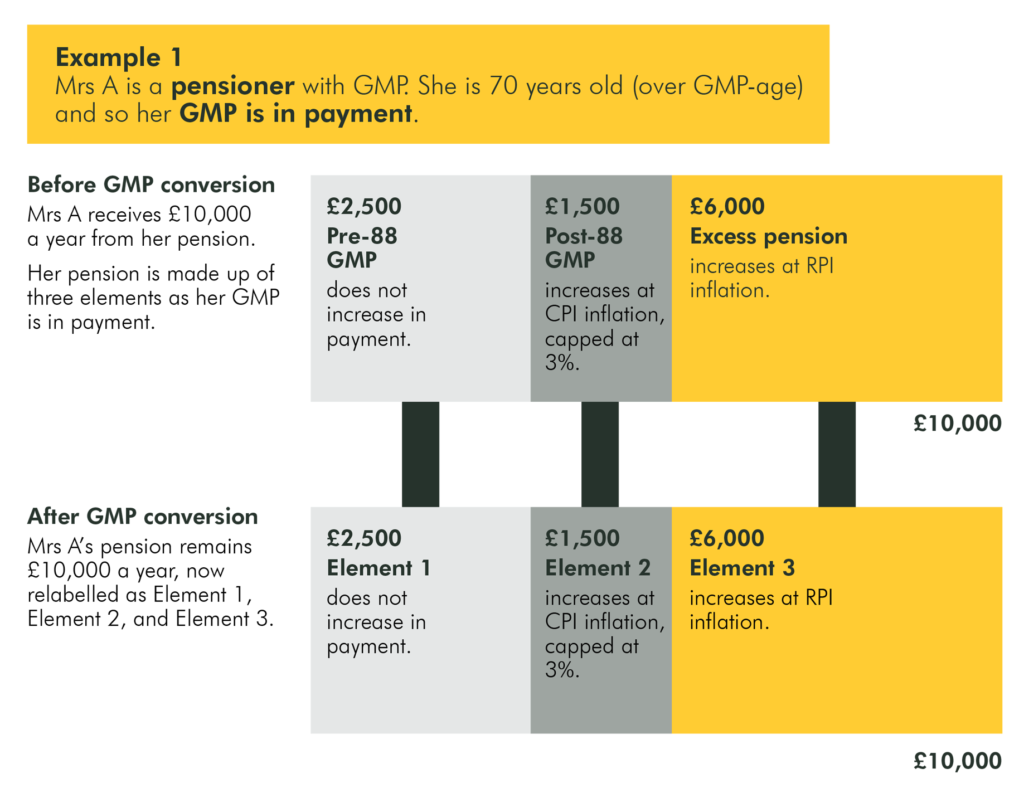

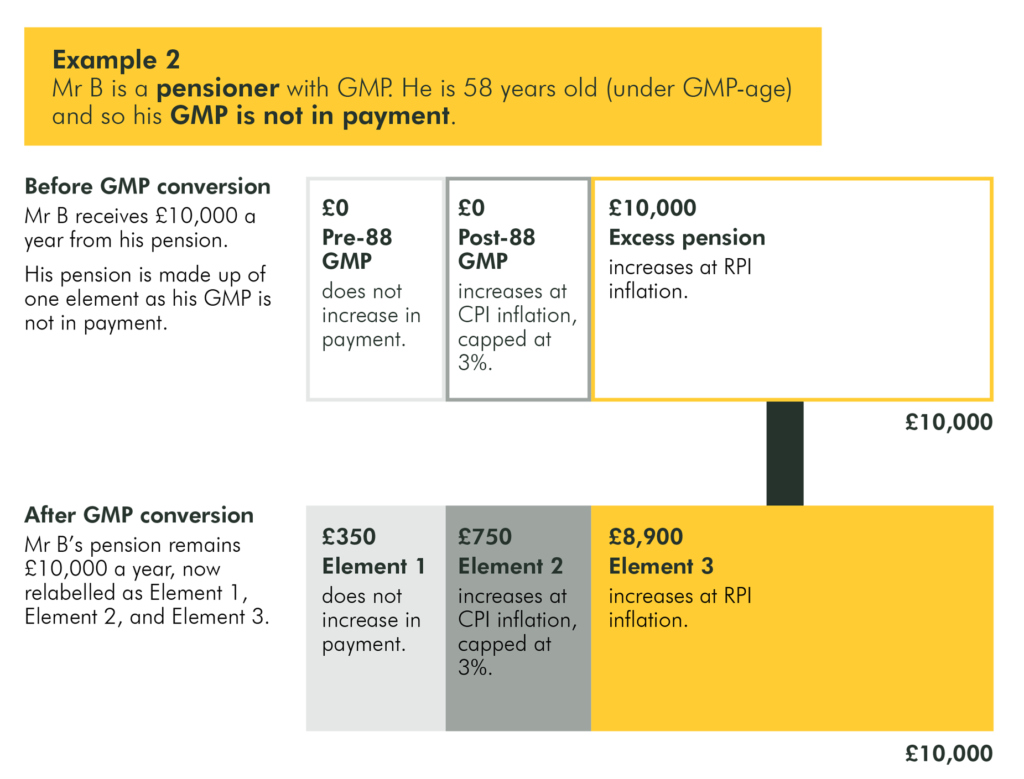

Here are two examples to help illustrate what might happen as a result of GMP conversion.

Please note that these examples are for illustration only. The terms of GMP conversion and how it will impact you will be determined at a future date. You will receive personalised information on how any changes affect your pension benefits, after these changes have been implemented.

Please be aware the age GMP comes into payment is at your GMP age, where GMP age is 60 years for women and 65 years for men.

What does this mean for Mrs A? The conversion would result in no change to pension amount or current overall value, the only change would be the relabelling of each element.

What does this mean for Mr B?

Mr B’s current pension at the point of conversion is unchanged but is reshaped, as the different increases that exist within the Scheme now come into effect from the point of conversion rather than at GMP age. This timing change results in lower allocations to Elements 1 and 2, and hence a higher allocation to Element 3 which increases at a higher rate. The amount of pension has stayed the same – but the current overall value of the new post-converted pension is the same as the pre-converted pension.

In this example, the amounts forming the elements change, but the current overall pension value and the total pension amount are unchanged.

GMP conversion will be carried out at the time retirement benefits are taken, with the same principles applied. For example, if a deferred member takes their retirement benefits at age 58, ‘Example 2’ illustrates the effect of GMP conversion.

Understanding GMP

Guaranteed Minimum Pension (GMP) is the result of ‘contracting-out’ of the State Pension.

Many defined benefit pension schemes were contracted out of the State Earning Related Pension Scheme (SERPS) between 6 April 1978 and 5 April 2002 and the State Second Pension between 6 April 2002 and 5 April 2016 (S2P). SERPS and S2P provided a top-up to the Basic State Pension. As a result, both members and participating employers paid lower National Insurance contributions. In exchange, the schemes took on responsibility for paying the equivalent ‘top-up’ pension their members would have earned through SERPS and S2P.

If you had contracted-out service between 6 April 1978 and 5 April 1997, when you were a member of the Scheme, this part of your pension is called GMP. GMP is the guaranteed minimum pension the Scheme had to provide to you if you had contracted-out membership during this period, once you reach GMP age. GMP age is 65 for men and 60 for women.

If you have GMP, we’ll write to you in due course to tell you how GMP conversion will affect your pension. However, if you are curious and are in receipt of your pension, then your annual pension increase letter has a breakdown of your pension elements, including GMP.

It’s worth noting that if you’re in receipt of a pension that is only paid once a year, then you have Equivalent Pension Benefit only and do not have GMP.

| You might have a Guaranteed Minimum Pension if you had a pension with the scheme between 6 April 1978 and 5 April 1997. | You probably won’t have one if you joined the pension scheme after 5 April 1997. |

| You will have a Guaranteed Minimum Pension if you are receiving a dependant’s pension with a widow’s or widower’s Guaranteed Minimum Pension within it. | You won’t have one if you have a children’s pension, or if you are paid annually and your pension is entirely made up of Equivalent Pension Benefit (EPB). |

Historically, the way that GMP was calculated and increased each year differed for men and women. Following a recent High Court judgement, pension schemes must now equalise pension benefits for men and women to take account of the unequal effects of GMP within the pension entitlement. The process by which this is achieved is known as GMP equalisation.

GMP conversion means that the pre-88 GMP, post-88 GMP, and ‘excess pension’ elements of the pension entitlement would be valued, balanced to retain the same current overall value of pension, and relabelled in a one-off adjustment.

Each of the elements, which might make up your pension, increase in different ways. Increases applied to the relabelled elements will remain unchanged. In their place will be new elements, with a different name, but which will increase in the same way. Although if you are under GMP age, these new pension elements (and their associated increases) will apply from the point of conversion rather than from your GMP age. This is illustrated in Example 2 above.

GMP conversion will also take into account any impact of GMP equalisation that may result in a modest reshaping of your pension.

Your pension is made up of up to four elements:

- Equivalent Pension Benefit (‘EPB’), built up in the 1960s and early 1970s;

- GMP built up between 6 April 1978 and 5 April 1988 (pre-88 GMP);

- GMP built up between 6 April 1988 and 5 April 1997 (post-88 GMP); and

- the non-GMP excess, which is the amount of your Scheme pension above the GMP.

The GMP notionally increases in line with the Retail Prices Index (RPI) from the date you leave the Scheme until you reach GMP age. However, the Department for Work and Pensions (DWP) has agreed that pension schemes like ours can revalue your GMP at a fixed rate for each complete tax year between when you left the Scheme and your GMP age. The rate we apply as an increase to your GMP depends on when you left the Scheme, as the following table shows:

| Date of leaving the Scheme | Fixed rate of revaluation |

| 6 April 2017 – 5 April 2022 | 3.5% |

| 6 April 2012 – 5 April 2017 | 4.75% |

| 6 April 2007 – 5 April 2012 | 4.0% |

| 6 April 2002 – 5 April 2007 | 4.5% |

| 6 April 1997 – 5 April 2002 | 6.25% |

| 6 April 1993 – 5 April 1997 | 7.0% |

| 6 April 1988 – 5 April 1993 | 7.5% |

| Before 6 April 1988 | 8.5% |

When you reach GMP age, we do a test to give you the better of the notional RPI increase and the fixed-rate revaluation, from the date you left the Scheme. If the fixed-rate increase on the GMP is higher than RPI, your pension will be increased. This is known as an ‘uplift’ and will be equal to the difference between the RPI and fixed-rate increases. This uplift will be brought forward to the point of conversion.

Example

| GMP at exit x RPI increases | £1,400.00 a year |

| GMP at exit x 7% increases | £2,000.00 a year |

| Uplift to pension at GMP age | £600.00 (£2,000.00 – £1,400.00) a year |

Once you reach GMP age, the Scheme will apply the following annual increases to your pension:

| Pre-88 GMP | 0% |

| Post-88 GMP | Consumer Prices Index (CPI), up to a maximum of 3% |

| Pension (Not GMP) | Retail Prices Index (RPI) for September of the previous year |

Your pension can be made up of up to four elements, which increase in different ways:

- The first is Equivalent Pension benefit (‘EPB’), a relatively small pension which resulted from Scheme membership in the 1960s and early 1970s.

- The second is Guaranteed Minimum Pension (‘GMP’) arising from Scheme membership from 1978-1988 (‘pre-88 GMP’).

- The third is Guaranteed Minimum Pension arising from Scheme membership from 1988-1997 (‘post-88 GMP’).

- The fourth element is the total pension less the three elements above, which is sometimes called ‘excess pension’.

You can find more information on GMP on the Pensions and Lifetime Savings Association website.

There is also Guidance on the use of the Guaranteed Minimum Pensions (GMP) conversion legislation information on the GOV.UK website.

Impact on pensions

While changes will apply to many members in the Scheme, in some cases only the names of the four different pension elements will change.

Your pension will not go down as a result of GMP conversion – and in some cases your pension could increase.

Elements of your pension might change over time, but the current overall value of your pension – both before and after GMP conversion – will stay the same.

You will get personalised information explaining how you may be affected by the changes when they are implemented.

- First of all, the pre-88 GMP, post-88 GMP, and ‘excess pension’ elements will be valued, using calculations carried out by the Scheme actuaries.

- Then these three elements may be adjusted, again using calculations carried out by the Scheme actuaries, retaining the same current overall value of pension.

- And the elements are also renamed.

This is a one-off adjustment. The Scheme’s actuary certifies that the current overall value of your total pension has not reduced.

Under GMP equalisation, it is possible that a member’s pension may be reduced, for a certain period, and then rise again to a level higher than it was originally. This is a very technical point which arises due the interaction of: (a) the method used for equalisation; and (b) the fact that the Scheme has a GMP step-up at GMP Age, which applies at different ages for males and females (65 for males but 60 for females).

However, where this falls in the pension due to GMP equalisation, the Trustee would expect that the member would receive a back payment because higher pension payments should have been paid to them in the past. The combination of this back payment and the subsequent rise in pension is expected to more than cover the decrease in pension over the period from when GMP equalisation is implemented to the time the pension rises. So, while a member might be better off overall, initially GMP equalisation could result in a drop in pension amount for a period of time.

GMP conversion looks to reshape the pension so that the overall value of the pension is unchanged. The objective of this reshaping is as far as possible: (a) to maintain the amount of pension at the same level it was after GMP equalisation, where equalisation has resulted in either no change to pension or an immediate increase; and (b) to maintain the amount of pension at the same level it was before equalisation, where equalisation has resulted in a decrease for the reasons described above. The expectation is that GMP conversion will achieve this in the vast majority, and perhaps all, cases. However, there may be a very small population of members who may see a reduction, after GMP conversion, especially if any reduction under GMP equalisation is very high. Until the calculations are carried out for all members during 2025, we will not know whether any members are affected by this, and to what extent, and the Trustee will review this position at that time.

Dependant pensions (whether currently in payment or becoming payable upon a member’s death) will be converted in the same way as other pensions with GMP.

Deferred members will also have GMP conversion applied to their pension benefits, but this will be carried out at the date at which they start receiving their pension from the Scheme. Again, deferred members will either see no changes to the overall actuarial value of the pension or may see a small increase as a result of GMP equalisation and conversion.

If you are approaching your retirement age soon, you will receive a retirement pack providing details of your retirement options from the Scheme. This information, along with information shown on My Retirement Planner, will be based on your current benefits. That means before any changes for equalisation or conversion of your GMP benefits, and until the at retirement equalisation and conversion process is available. We will confirm if and when the at retirement equalisation and conversion calculation results will be implemented, and we will review your pension and make any required changes to the amount in payment.

The levelling option is independent of GMP equalisation and GMP conversion. For the purposes of GMP conversion, we will not change any of the historic levelling amounts associated with the levelling option as part of the calculations.

There is a consistent set of rules governing benefits payable after your death. The details of this for deferred members and pensioner members are available on the corresponding sections of our website, except that they would be based on your converted pension.

Tax considerations

If you have applied for protection from changes to the lifetime allowance with HMRC on or after 15 March 2023 and have not yet told us, it’s important that you let us know using the contact details above.

We expect that this will only apply to a handful of members with total pensions valued at £1million or higher.

If an arrears payment is due, we can provide you with a statement which will break down that payment by tax years, to allow you to spread this across the tax years to which the arrears payment relates.

You will need to contact HMRC to get any arrears payment spread in this way and your tax liability recalculated (this is not something the Scheme would be able to do for you). Further information about this will be provided to members when post-conversion benefits are confirmed.

Any interest due will be identifiable at an aggregate level and not be split by tax year. Any interest due is paid without any tax deducted for UK residents and is covered by the Personal Savings Allowance. Whether tax is due on this amount will depend on your individual circumstances. We cannot provide you with any financial or tax advice in relation to your benefits.

Feedback and next steps

As the Trustee of the Scheme, we were required by law to consult with members whose benefits might be affected by GMP conversion before deciding whether to proceed with our plan for GMP conversion. We also wanted to be as transparent as possible about our intentions. This meant clearly explaining all the relevant information about the proposed changes and giving you the opportunity to provide your feedback before the consultation window closed on 28 February 2025.

We plan to carry out conversion for pensioners at the same time as GMP equalisation, starting in late 2025/early 2026. GMP equalisation/conversion for deferred members who commence payment of their benefits will follow in due course.

No, you won’t be able to opt out. There may be changes to your benefits, however you will not experience a reduction to the overall actuarial value of your benefits at the point of conversion.

This could be for a number of different reasons, for example a deferred member transfers out, or a member dies. Relatively few members will see their pension circumstances change.

We’ll conduct a separate review of past transfers out, and any further transfers out made prior to the time of implementation of GMP equalisation/conversion, to see if these transfers should be increased.

We’ll also conduct a separate review of death benefits, other than dependant pensions in payment, which will be included as part of the GMP equalisation exercise and will be included as part of the GMP conversion exercise.

Implementation

The Trustee will adopt a ‘minimal re-shaping’ (or ‘minimal interference’) approach, where the new post-conversion components of pension will be as close as possible in amount to the pre-conversion GMP and non-GMP elements; in many cases, the amounts will be the same and conversion will result only in re-labelling of the components – see ‘Example 1’.

There will be no new components introduced or changes to the range of different pension increases that apply to Scheme benefits. However, there may be circumstances in particular cases where additional re-shaping is required in order to ensure that, insofar as possible following GMP equalisation, members do not see a reduction in their current pension amount. The Trustee strongly believes that minimal re-shaping, whilst avoiding as much as possible a decrease in the amount of the current pension in payment, is the appropriate approach because it provides the greatest degree of continuity for members.

The GMP uplift calculation will be undertaken at the point of conversion and factored into the post conversion benefit. There will be no further GMP uplift calculation undertaken at GMP age.

At the current time, when you reach GMP age, a test is applied to give members the better of the RPI increase and the appropriate statutory fixed-rate revaluation, from the date the member left the Scheme. If the fixed-rate increase on the GMP is higher than RPI, the pension will be uplifted based on the difference between the RPI and fixed-rate increases.

Under the conversion design, this uplift does still apply but will be brought forward to the point of conversion. So, for any pensioner who is below GMP age at the point of conversion, this uplift will be applied at the point of conversion rather than the member having to wait until they reach GMP age. As the uplift is being provided at an earlier age, the amount of the uplift will be smaller as it will now be expected to be paid for a longer period.

A key requirement of the GMP conversion calculations is that the actuarial value of the benefits provided after conversion must be no lower than the actuarial value of the benefits before conversion, which provides protection for members. The starting point is that the value before and after conversion would be the same. So, because GMP conversion results in the same actuarial value before and after conversion, at the point of conversion all members see the same result in this respect, i.e. there are no ‘winners’ or ‘losers’.

The Trustee is required to obtain and consider advice from the Scheme Actuary in deciding what actuarial assumptions are appropriate for the GMP conversion calculations. In providing that advice, the Scheme Actuary must comply with actuarial professional standards.

As part of that advice, the Scheme Actuary has highlighted how the choice of different assumptions can affect the benefits awarded to members, and now that the decision to go forward with GMP conversion has been made, the Trustee will consider this advice in deciding on which assumptions to use. The most appropriate basis to use may be one based on the Cash Equivalent Transfer Value basis of calculation, which is a ‘best-estimate’ basis.

The basis of the calculation will be agreed now that the consultation period has finished.

At the current time, members who are below their GMP age (65 for males and 60 for females) have a Scheme pension which is entirely made up of excess pension. However, once such members reach GMP age, their Scheme pension is split between excess, Pre 1988 GMP and Post 1988 GMP. In addition, on reaching GMP age the pension is subject to a test in relation to the GMP and, if necessary, the pension will be subject to an uplift payable from GMP age (whether this uplift does or does not apply will depend on each member’s own circumstances). In other words, prior to GMP age, a member will only have excess pension, but some of that excess pension will become GMP on and from their GMP age.

Under GMP conversion, for those members who are under their GMP age, it will be necessary to separate their Scheme pension out into the different elements at the point of conversion rather than waiting until they reach their GMP age. As such, some excess pension at this point will be converted into ‘GMP-like’ elements (i.e. not pre 88 GMP and post 88 GMP, but elements that increase in the same way in payment), and different increases will then apply to those elements, but this is only “bringing forward” what would have happened at GMP age if GMP conversion did not proceed.

This process may result in lower increases to total pension than would otherwise have been the case if GMP conversion had not taken place before GMP age. However, this will be balanced by expected higher increases to total pension after GMP age than would otherwise have been the case if GMP conversion had not taken place. In other words, a lower allocation to excess pension before GMP age should be offset by a higher allocation to excess pension after GMP age. In addition, in undertaking GMP conversion, those members who would have received a GMP uplift from their GMP age will now receive an uplift from the point of conversion instead.

No, there is no loss of guarantee. We understand that the term “guaranteed” in the “Guaranteed Minimum Pension” may create the impression that this part of your pension has some sort of guarantee that the rest of your pension does not. However, this is not the case and, under the Rules of the Scheme, your entire pension benefit must be paid by the Trustee subject to the Rules of the Scheme and applicable law. No preference is (or can be) given to paying the GMP element of your pension over any other element of your pension in excess of the GMP.